I agree to and consent to receive news, updates, and other communications by way of commercial electronic messages (including email) from New Break Resources Ltd. I understand I may withdraw consent at any time by clicking the unsubscribe link contained in all emails from New Break Resources Ltd.

New Break Discusses Critical Minerals Potential at Moray Property and Closes Final Tranche of Non-Brokered Private Placement

Toronto, Ontario, March 6, 2024 – New Break Resources Ltd. (“New Break” or the “Company”) (CSE: NBRK) is pleased to discuss the critical minerals potential of the Moray property, in light of significant developments with respect to contiguous properties.

The 8,483-hectare Moray property is located approximately 49 km south of Timmins, Ontario and 32 km northwest of the Young-Davidson gold mine, operated by Alamos Gold Inc. (“Alamos Gold”). While the principal focus to date at the Moray property has been to evaluate the gold potential and more specifically, the analogous nature of gold mineralization at Moray to that at the nearby Young-Davidson gold mine, the northwestern border of the Moray property is also contiguous with the Texmont Project, owned by TSX Venture Exchange listed Canada Nickel Company Inc. (“Canada Nickel”) and the southern boundary is contiguous with the Edleston Project, owned by Australian listed Aston Minerals Limited (“Aston Minerals”).

(Figure 1 – Map of New Break Resources Ltd.’s Ontario Properties)

About Aston Minerals’ Edleston Project

The Edleston Project boasts JORC Code (2012) mineral resource estimates of 155 million tonnes grading 0.28% Ni and 0.011% Co indicated and 889 million tonnes grading 0.27% Ni and 0.011% Co inferred as well as a gold zone having 14.0 million tonnes grading 0.90 g/t Au for 400,200 ounces indicated and 34.1 million tonnes grading 1.0 g/t Au for 1,099,800 ounces inferred. (Source: Aston Minerals corporate presentation at http://astonminerals.com.) Disclaimer: The mineralization style and setting associated with the Edleston Project is not necessarily indicative of the mineralization observed on the Moray property.

About Canada Nickel and the Texmont Project

Canada Nickel purchased the past producing Texmont mine in March 2023, which adds to their portfolio of properties within their “Timmins Nickel District” and hosts a non-compliant National Instrument 43-101 historical mineral resource estimate of 3.2 million tonnes grading 0.9% Ni. In January 2024, Agnico Eagle Mines Limited (“Agnico Eagle”) invested $34.7 million in Canada Nickel, which will be used to continue to unlock the potential of the Timmins Nickel District, which they “believe has the potential to be one of the world’s largest nickel sulfide districts”. (Source: Canada Nickel news release January 2, 2024).

Moray Property – Historical Ni-Cu Occurrences

The Moss Lake ultramafic unit was drilled in 1974 by Pan Ore Gold Mines Ltd. (“Pan Ore”), who drilled three holes for a total of 306.3 metres. Only some assays were reported, including drillhole PO-2 that intersected 0.24% Ni over 6.5 feet in a contact between a rhyolite breccia and serpentinite.

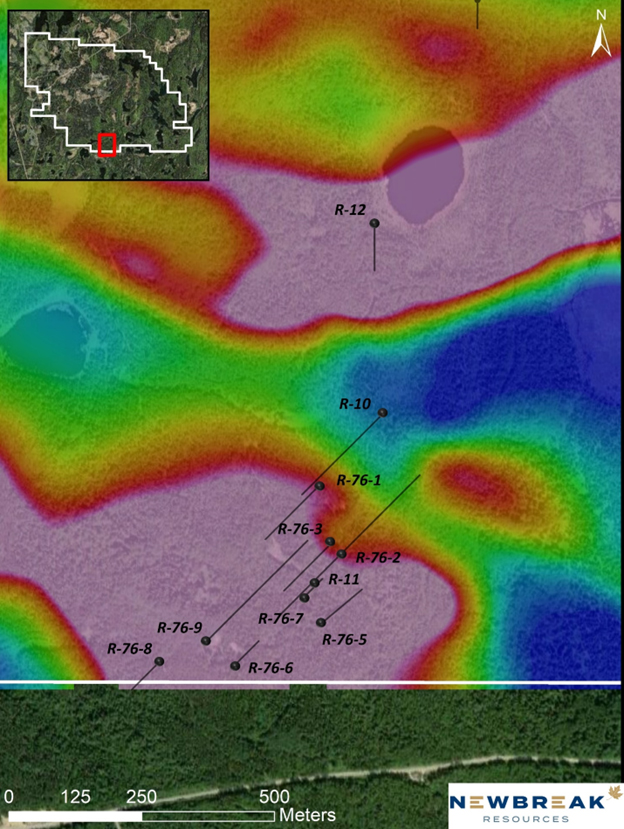

The Ni-Cu occurrences at Moray are associated with serpentinized ultramafic rocks with co-incident magnetic highs. Rio Tinto Canadian Exploration Ltd. (“Rio Tinto”) optioned the property from Pan Ore in 1975. In 1976 and 1977, Rio Tinto drilled the Dexter Lake grid with 11 holes (R-76-1 to R-76-3, R-76-5 to R-76-9 and R-10 to R-12). The assay results were not disclosed. However, management believes that it is apparent from the drilling, that they were following a massive and disseminated sulphide horizon. The drill log for drillhole R-76-2, details a sulphide horizon from 275.5 to 284.0 feet with up to 85% pyrite, pyrrhotite, chalcopyrite, sphalerite and galena. In 1999, Claim Lake Resources Inc. (“Claim Lake”) located and relogged several of the Rio Tinto drillholes including R-76-2, R-76-5, R-76-6 and R-76-7. Claim Lake stated that, “the key sulfide bearing interval in R-76-2 was not recovered either because it was not stored onsite (most likely) or because it could not be identified.” Claim Lake also stated that, “The nickel and base metal exploration potential of the property has been enhanced. Original drilling was designed to test the association of airborne E-M conductors with base-metals, but neither the base metal nor the nickel potential appears to have been fully tested.”

Moss-Trembly Nickel and Base Metal Showing at Dexter Lake

A new nickel showing was reported by Moss Resources Inc. in 1998 (Moss Resources Inc. news releases August 18, 1998 and September 17, 1998). Previous historical results reported by Moss Resources Inc. include 2.2% Ni and 0.13% Cu over 5 feet, 0.67% Ni over 26 feet and 0.31% Ni over 182 feet.

(Figure 2 – Map of 11 drillhole locations for 1976-1977 drilling by Rio Tinto on Dexter Lake grid)

Table 1: Summary of Drillhole Logs Rio Tinto Drilling 1976-1977 – Dexter Lake Grid

| Drillhole | Depth (m) | Azimuth | Dip | Lithology and Mineralization Encountered | Other Comments |

| R-76-1 | 215.49 | 225⁰ | -50⁰ | 100 m thick rhyolite-dacite and fragmentals with two thin interbedded. Komatiitic peridotite flows. Dacite has disseminated pyrrhotite (“po”), bx with 10% pyrite (“py”) and up to 6% sphalerite (“sp”) from 125-131 m. | Intersected base metal mineralization in surface trenches. Lower komatiite has up to 10% po, minor chalcopyrite. |

| R-76-2 | 252.98 | 225⁰ | -50⁰ | Mainly peridotitic komatiite, 2.6 m thick banded, massive py, po, sp, chalcopyrite (“cp”), galena (“ga”) at 84 m in “mottled serpentine talc”. | No rhyolite, dacite or andesite described in drillhole. |

| R-76-3 | 194.46 | 225⁰ | -50⁰ | Dacite, dacite tuff, lapilli tuff, andesite, trace po, sp, chalcopyrite 8 m rhyolite and rhyolite breccia with trace po, sp, cp. 26 m rhyolite and rhyolite bx with sp, po, cp. Komatiite with 25% po, pentlandite (“pn”), py. | Komatiite sequence separates dacite-andesite from rhyolite and rhyolite breccia. |

| R-76-5 | 152.40 | 50⁰ | -50⁰ | Peridotitic komatiites with up to 10% po, py, 14 m rhyolite and chlorite, altered rhyolite, 78 m thick komatiite sequence, dacite agglomerate. | |

| R-76-6 | 91.44 | 45⁰ | -45⁰ | Peridotitic komatiites 2-4% nickeliferous po, po, pyrite. | |

| R-76-7 | 142.65 | 45⁰ | -70⁰ | Komatiitic flow sequence > 140 m thick. 1.8 m thick altered tuff. Up to 10% nickeliferous po, pn, pyrite. | |

| R-76-8 | 105.46 | 225⁰ | -47⁰ | To test EM-17 anomaly komatiite sequence, intersected contact with dacite at 86.6 m. | Anomaly associated with/by komatiite-dacite contact. |

| R-76-9 | 375.82 | 45⁰ | -45⁰ | 12 m chlorite altered rhyolite and rhyolite breccia, trace sp; thick komatiitic dunite and peridotite sequence with disseminated and interstitial po, chalcopyrite up to 15% over several metres. | Did not drill through komatiite to intersect basal contact. |

| R-10 | 431.90 | 225⁰ | -60⁰ | 4332 m of rhyolite, dacite and fragmental equivalents, with two komatiitic peridotite sequences (23 and 50 m thick) interbedded. Rhyolite fragments in chloritic matrix. Disseminated sp. Peridotite with 5-10% disseminated po, pyrite. | |

| R-11 | 319.13 | 45⁰ | -50⁰ | 93 m komatiitic, including 50 cm 20% pn blebs, 125 m rhyolite, fragmental and altered equivalents, including two beds of 10% disseminated sp, py. | |

| R-12 | 121.01 | 180⁰ | -45⁰ | 71 m komatiite, 50 m dacite and rhyolite and fragmental equivalents, cherty and graphitic tuff with trace sp, up to 3 m thick. | |

(Source: Technical (Geological) Report prepared for District Canada Inc. dated August 31, 2011)

Ontario Junior Exploration Program

On February 29, 2024, New Break submitted two final reports to the Ontario Ministry of Mines, relating to the Moray Project in respect of the 2023-2024 Ontario Junior Exploration Program. If accepted, the Company expects to receive reimbursements of $36,224 under the third intake, of which $30,000 has been received to date, and $200,000 under the fourth intake, none of which has been received to date. All reimbursements received will be put back into exploration of the Moray Project during 2024.

Qualified Person

Peter C. Hubacheck, P. Geo., consulting geologist to New Break, and a Qualified Person as defined by National Instrument 43-101, has reviewed and approved the technical disclosure in this news release.

Corporate Update – Non-Brokered Private Placement

The Company also wishes to announce that effective March 5, 2024, it has closed the final tranche of the non-brokered private placement first announced on December 23, 2023 and extended on January 23, 2024, through the issuance of 250,000 units (“Units”) at a price of $0.08 per Unit for gross proceeds of $20,000. Each Unit consists of one common share (“Common Share”) of the Company and one common share purchase warrant (“Warrant”), with each Warrant entitling the holder thereof, to purchase one additional Common Share of the Company at a price of $0.12 for a period of twenty-four (24) months from the date of issuance.

The Warrants are subject to an acceleration clause, whereby if the closing price of the Common Shares of the Company on the Canadian Securities Exchange (the “CSE”) is equal to $0.25 or higher for five non-consecutive trading days, over a 365-day period, the Company may accelerate the expiry of the Warrants to the date that is 20 business days from the date of the issuance of a news release by the Company announcing the exercise of the acceleration right.

The proceeds from the sale of the Units will be used for general working capital purposes. No finder’s fees were paid in connection with the closing. All securities issued pursuant to this private placement are subject to a statutory hold period of four months and one day expiring on July 6, 2024, in accordance with applicable Canadian Securities Laws. The completion of the closing is subject to certain conditions including, but not limited to, the receipt of all required regulatory approvals including final approval of the CSE.

Jim O’Neill, an officer of New Break, purchased a total of 125,000 Units. This issuance of securities constitutes a “related party transaction” as such term is defined under Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions (“MI 61-101”). The Company is relying on an exemption from the formal valuation and minority shareholder approval requirements provided under MI 61-101 pursuant to section 5.5(a) and section 5.7(1)(a) of MI 61-101, on the basis that the issuance of the securities does not exceed 25% of the fair market value of the Company’s market capitalization.

About New Break Resources Ltd.

New Break is a Canadian mineral exploration company with a dual vision for value creation. In northern Ontario, New Break is focused on its Moray Project, in a well-established mining camp, within proximity to existing infrastructure, while through our highly prospective Nunavut properties that include the Sundog and Esker Projects, we provide our shareholders with significant exposure to the vast potential for exploration success in one of the most up and coming regions in Canada for gold exploration and production. New Break is supported by a highly experienced team of mining professionals committed to placing a premium on Environmental, Social and Corporate Governance. Information on New Break is available under the Company’s profile on SEDAR+ at www.sedarplus.ca and on the Company’s website at www.newbreakresources.ca. New Break began trading on the Canadian Securities Exchange (www.thecse.com) on September 7, 2022 under the symbol CSE: NBRK.

For further information on New Break, please visit www.newbreakresources.ca or contact:

Michael Farrant, President and Chief Executive Officer

Tel: 416–278–4149

E-mail: mfarrant@newbreakresources.ca

And follow us on Twitter, LinkedIn and Facebook

No stock exchange, regulation securities provider, securities commission or other regulatory authority has approved or disapproved the information contained in this news release.

CAUTIONARY NOTE REGARDING FORWARD LOOKING INFORMATION

Except for statements of historic fact, this news release contains certain “forward-looking information” within the meaning of applicable securities law. Forward-looking information is frequently characterized by words such as “plan”, “expect”, “project”, “intend”, “believe”, “anticipate”, “estimate” and other similar words, or statements that certain events or conditions “may” or “will” occur. Forward-looking statements are based on the opinions and estimates at the date the statements are made, and are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those anticipated in the forward-looking statements including, but not limited to receipt of regulatory and stock exchange approvals, grants of equity-based compensation, renouncement of flow-through exploration expenses, property agreements, timing and content of upcoming work programs, geological interpretations, receipt of property titles, an inability to predict and counteract the effects global events on the business of the Company, including but not limited to the effects on the price of commodities, capital market conditions, restriction on labour and international travel and supply chains etc. Forward-looking information addresses future events and conditions and therefore involves inherent risks and uncertainties, including factors beyond the Company’s control. Accordingly, readers should not place undue reliance on forward-looking information. The Company undertakes no obligation to update publicly or otherwise any forward-looking information, except as may be required by law. Additional information identifying risks and uncertainties that could affect financial results is contained in the Company’s financial statements and management’s discussion and analysis (the “Filings”), such Filings available upon request.